A recent analysis by Fidelity Digital Assets has provided a detailed forecast for Bitcoin (BTC) and Ethereum (ETH), which suggests promising prospects for investors in these digital currencies. The report’s findings are particularly impactful for those investing in the Fidelity Wise Origin Bitcoin ETFs (FBTC), instilling greater confidence in their investment decisions.

Bitcoin ETFs Experience Surge of Investments

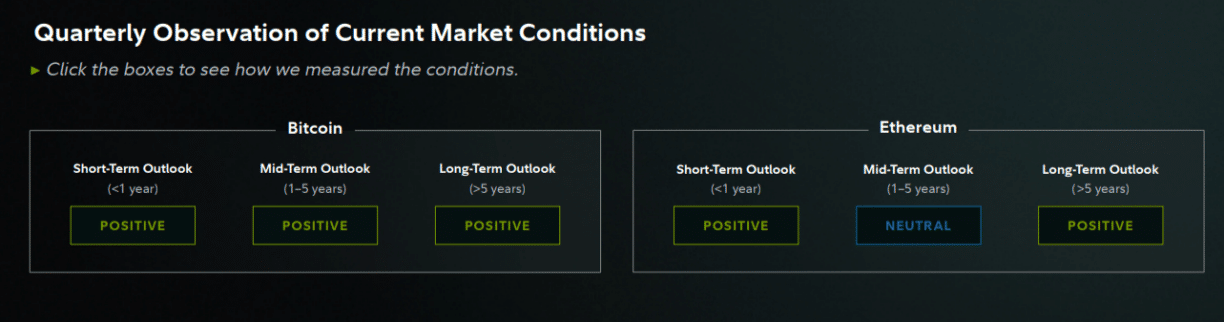

On a notable day, February 7th, FBTC witnessed a substantial investment inflow of $130 million. This figure is part of a larger sum of $145 million directed towards 10 distinct spot Bitcoin ETFs. Fidelity Digital Assets delved into various market indicators, encompassing on-chain data and other signals. These indicators support a positive outlook for Bitcoin through the end of 2023 and extend well into the next five years and beyond.

Evaluating Key Metrics for Bitcoin

Fidelity’s short-term Bitcoin predictions incorporate analyses such as the 200-day moving average and the presence of a golden cross. These, coupled with the current price surpassing the realized price, contribute to a bullish market projection for 2024. Three pivotal elements underpin this optimism: interest rate trends, the anticipated Bitcoin halving event, and the performance of spot Bitcoin ETFs. The medium-term forecast until 2028 also appears favorable, with positive signs from various metrics like the NUPL ratio, MVRV Z-Score, and others pointing towards an upbeat price trajectory for Bitcoin.

Assessing Ethereum’s Market Movement

Looking towards Ethereum, the long-term forecast is similarly upbeat with several factors such as price trends over 200 weeks and the growth of monthly active addresses. Short-term Ethereum predictions also leverage analyses like the 200-day moving average. For the medium-term outlook leading up to 2028, similar metrics to Bitcoin are evaluated, alongside Ethereum-specific indicators such as staking activity and net issuance. These factors collectively contribute to a positive long-term forecast for Ethereum’s price.