Token unlock events have a pronounced effect on altcoin market prices, often resulting in significant fluctuations. These events can drastically undermine the value of a cryptocurrency if additional demand isn’t stimulated to absorb the increased supply. Many significant token releases are scheduled in the near-term, highlighting the potential for price swings.

Initial Price Spikes and Subsequent Struggles

Newly launched altcoins usually hit the market with a restricted supply, which can lead to early price surges. Yet, as their supply expands, these currencies seldom match the peak prices seen during their market debut. DYDX serves as a case in point; starting with a supply of 80 million, it saw prices nearing $27 but now struggles to sustain such levels as its supply grows. In contrast, XRP Coin, despite potentially regaining its high market value, would only see prices around $1.3.

Upcoming Unlock Events and Market Implications

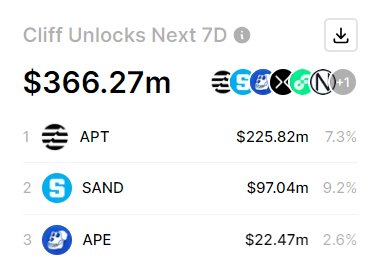

Aptos is slated to release 7.32% of its total tokens, valued at approximately $224.82 million. On February 14th, an even larger proportion of SAND tokens will enter circulation, totaling over $96 million, which could precipitate a price decrease barring unforeseen market activity. ApeCoin is also on the calendar to unlock 2.6% of its supply, equating to $21.84 million on February 16th.

The AVAX team is preparing for one of February’s most substantial token unlocks, with $363.5 million worth of tokens or 2.5% of its total supply set for release on the 21st. OP Coin is also expecting an unlock, highlighting the potential for increased token inflation and the associated risks for investors. Nonetheless, these effects can be mitigated or even reversed with strategic actions like postponing unlock events, announcing new initiatives, or forming key partnerships.