Bitcoin‘s value remains just below the $73,000 threshold, currently trading at $72,804. Amidst this market backdrop, MicroStrategy is making headlines with its significant Bitcoin purchases in the third quarter. The focus now shifts to the Solana (SOL) cryptocurrency as it seeks regulatory approval for its exchange-traded funds (ETFs).

SOL ETF Application Status

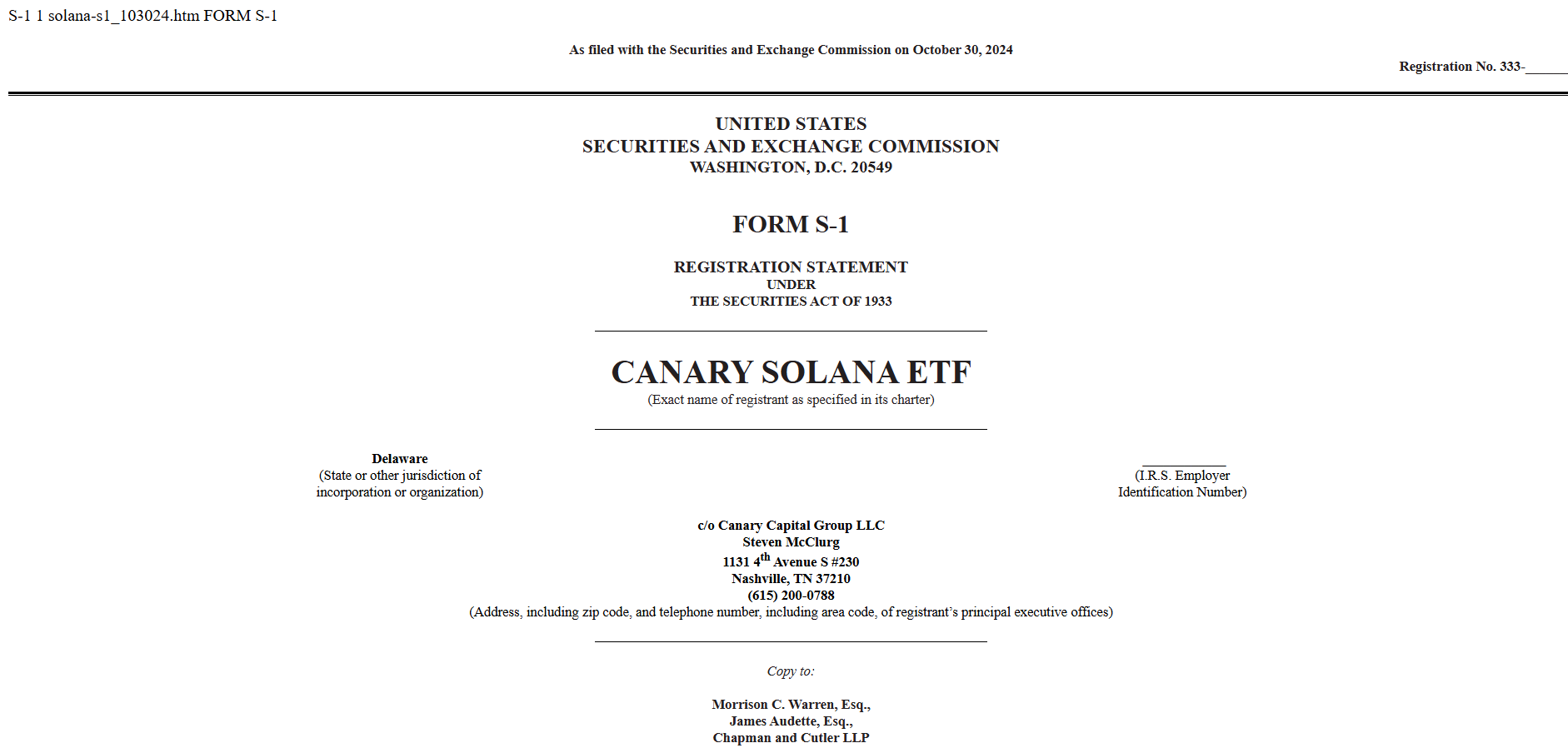

Previously submitted applications for Solana ETFs were stalled due to the SEC’s stringent regulations. However, a new application from Canary Capital Group has recently been submitted, raising questions about the motivations behind this move, especially given SEC Chairman Gary Gensler’s assertion that many altcoins qualify as securities.

What Happens If Trump Wins?

If Donald Trump is successful in the upcoming elections on November 5, he intends to replace the current SEC chairman with someone more aligned with crypto interests. This shift could pave the way for a more favorable regulatory environment for Solana, particularly since Gensler has already approved an ETF for Ethereum.

What If Kamala Harris Wins?

In the event of a Kamala Harris victory, her promise to expedite regulatory measures could bolster innovation in the crypto sector, although her policies may not mirror Trump’s. Notably, new administrations often bring changes in SEC leadership, which could benefit Solana ETFs, especially considering the current chairman’s potential departure.

- Canary Capital’s new S-1 Form submission indicates renewed interest in Solana ETFs.

- Trump’s potential SEC chair appointment could create a more favorable landscape for crypto assets.

- Harris’s election may still facilitate regulatory changes, despite possible limitations.

The unfolding political landscape will significantly impact the future of Solana ETFs, with potential shifts in regulatory policy hinging on the outcome of the upcoming elections.