Ethereum ETF funds have reached a new milestone in the cryptocurrency market, drawing significant attention. On August 1, despite Grayscale’s Ethereum Trust experiencing cumulative outflows surpassing $2 billion, daily net inflows into U.S.-based spot Ethereum exchange-traded funds turned positive once more.

What’s Driving the Inflows?

Ethereum ETF funds reported a notable net inflow of $28.5 million on August 1, with BlackRock’s iShare Ethereum Trust (ETHA) leading the charge by attracting $91.4 million. This influx comes in stark contrast to Grayscale’s Ethereum Trust, which saw a $78 million outflow in a single day, taking its total outflows to over $2 billion since its conversion to a spot fund.

The Grayscale Ethereum Trust, initially a vehicle for institutional investors, held a whopping $9 billion worth of Ethereum prior to its conversion on July 23. Today’s outflow data suggests that 22% of the initial fund has been liquidated. Analysts are observing these trends closely, with some predicting that the slowing outflows could signify a stabilizing price for Ethereum.

Could Slowing Outflows Signal Stability?

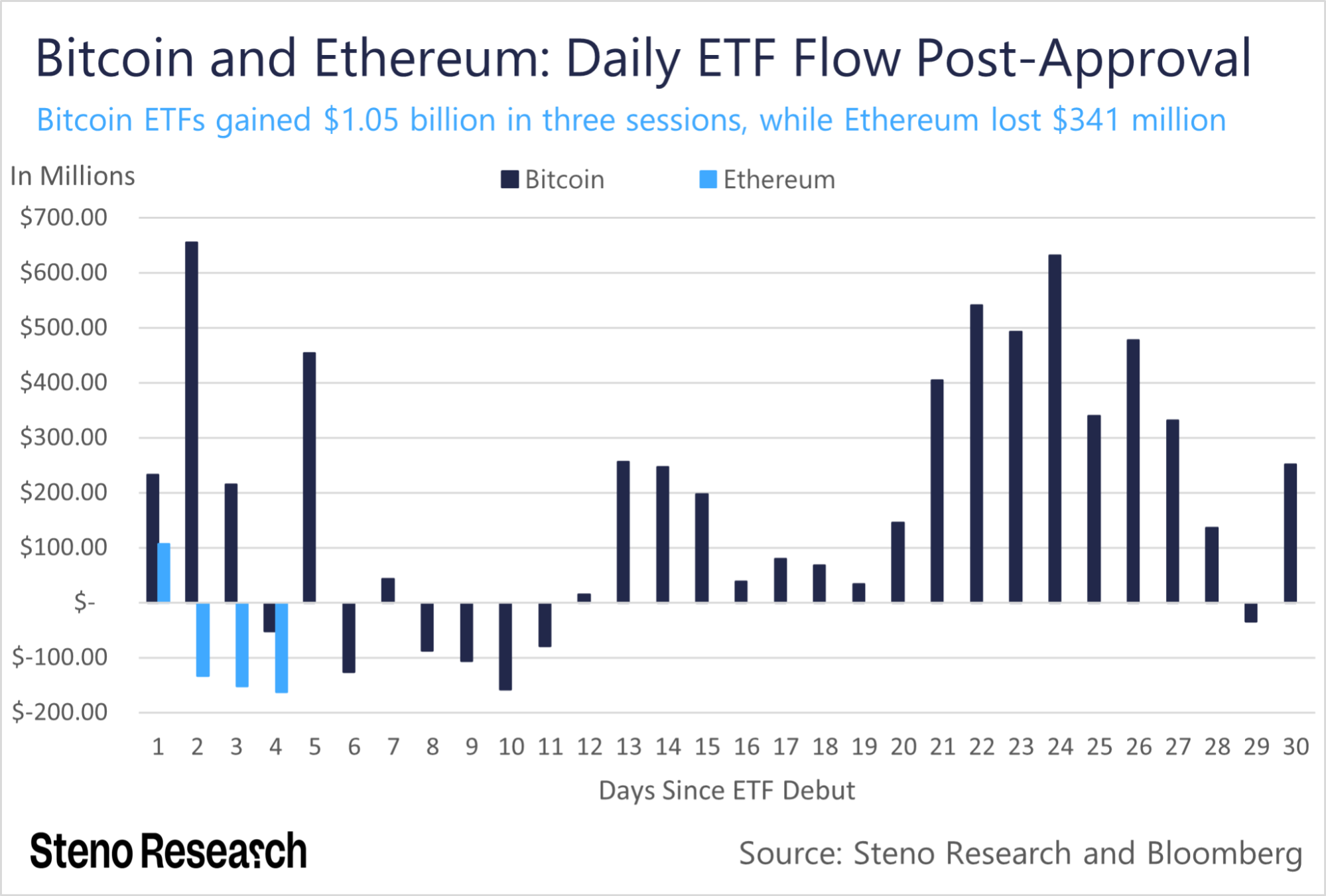

Steno Research senior analyst Mads Eberhardt suggested that the decline in outflows from Grayscale’s Ethereum Trust could slow down by the end of the week, potentially boosting Ethereum’s price. Eberhardt’s analysis indicates a positive outlook, stating that once outflows diminish, Ethereum’s price is likely to recover.

Similarly, Will Cai, head of index at Kaiko, noted that Ethereum’s price is highly responsive to inflows into spot products. Reflecting this sensitivity, Ethereum was trading at $3,168, down 8.5% since the ETF funds’ launch, as per TradingView data. Recent selling pressures have continued to impact Ethereum’s market value adversely.

Key Takeaways for Investors

- Daily net inflows into Ethereum ETFs have turned positive, signaling renewed investor interest.

- BlackRock’s iShare Ethereum Trust led the inflows with $91.4 million.

- Grayscale’s Ethereum Trust has seen significant outflows, totaling over $2 billion.

- Analysts suggest that slowing outflows could stabilize Ethereum’s price.

In conclusion, the recent movements in Ethereum ETF funds present a dynamic shift in the market. While Grayscale’s fund continues to see outflows, other ETFs are gaining traction, potentially indicating a turning point for Ethereum’s price stability.