Recent data from the United States may significantly influence cryptocurrency markets. With the uncertainty around tariffs easing, the anticipated sharp decline in cryptocurrency values has not materialized. If the market remains stable, a rebound in cryptocurrency values could potentially start in the next quarter. But what are the implications of the latest reports from the U.S.?

What Do Recent U.S. Reports Reveal?

Can Lower Interest Rates Propel Crypto Demand?

Following tariff adjustments, trade partners of the U.S. may increase money supply and consider lowering interest rates to stimulate local demand. As fears of a global recession escalate, the Federal Reserve’s strategy appears to align with this approach. Countries like China, noted for their rapid economic measures, ramping up liquidity could invigorate the demand necessary for cryptocurrency growth.

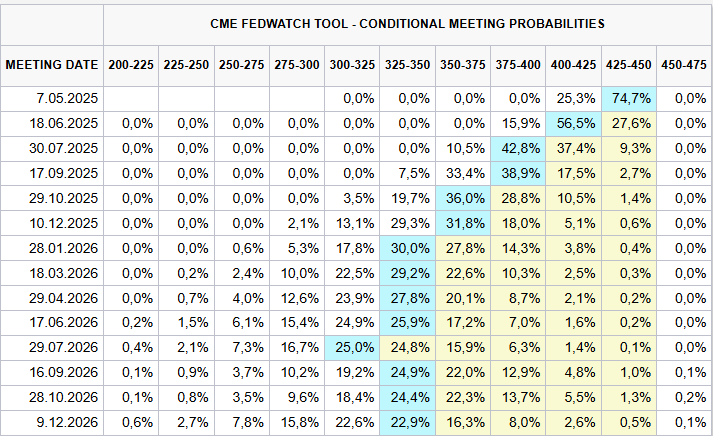

Newly released data on the U.S. trade balance and initial unemployment claims offers critical insights. The impact of tariffs on employment will be monitored closely with this data over the coming weeks and months. Should job market indicators show weakness, the Federal Reserve might hasten its easing policies. Market forecasts are now suggesting four interest rate cuts this year, a notable shift from previous expectations of just one or two for 2025.

U.S. Secretary of Commerce Lutnick emphasized that interest rates in the U.S. will significantly decrease and urged international partners to refrain from retaliatory measures.

- U.S. Trade Balance: -$122.7 Billion (Forecast: -$123.5 Billion; Previous: -$131.4 Billion)

- Initial Unemployment Claims: 219K (Forecast: 225K; Previous: 224K)

- Continuing Unemployment Claims: 1.903M (Forecast: 1.84M; Previous: 1.856M)

The higher-than-expected unemployment claims could play a pivotal role in shaping interest rate cut expectations. The timing of the Secretary’s comments on interest cuts is vital for the cryptocurrency sphere; however, new unemployment claims falling below expectations has dampened some optimism. Furthermore, the reduction in the trade deficit with China by nearly $10 billion suggests initial tariff effects are taking shape. The current stability in economic conditions is advantageous for cryptocurrencies.